The Complete Stock Screening Experience

Get instant stock analysis and insights for smarter trading decisions.

1.

50+ Readymade Screeners

Pre-built screens tools help you quickly identify promising stocks using fundamental, intraday, and technical analysis parameters, saving valuable research time.

2.

150+ Stock Filters

Advanced filtering capabilities allow you to sift through thousands of stocks with razor-sharp precision, tailored to your specific investment approach and market preferences.

3.

Advanced Screening Mode

Compare detailed stock fundamentals with sophisticated operators and parameters, enabling precise tracking and comprehensive market insights.

4.

Stock Market Insights

Compare detailed stock fundamentals with sophisticated operators and parameters, enabling precise tracking and comprehensive market insights.

5.

Sectoral Research

Deep-dive sector analysis tools utilizing key metrics like PE, PB, EBITDA Margin, and specialized screeners to understand industry trends and opportunities.

6.

Create & Share Screens

Build custom stock screeners and save your research setups, plus share your screening strategies with fellow traders and the investment community.

7.

Updates FII & DII Trends

Monitor institutional buying and selling patterns with daily, weekly, and monthly tracking of Foreign and Domestic Institutional Investor activities.

Readymade Stock Screeners For Deeper Insights

Access a readymade stock screener that gives you deeper market analysis. Quickly find trends, opportunities, and make informed trading decisions with powerful tools which is designed for advanced investors.

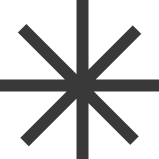

Stock Screener

Explore live market data using our AI-powered stock screener. Quickly apply smart filters that analyze thousands of stocks and uncover market trends. Get instant insights and recommendations to guide your trading choices with confidence.

Stock Screener

Ratio Screener

Dhanarthi Screener

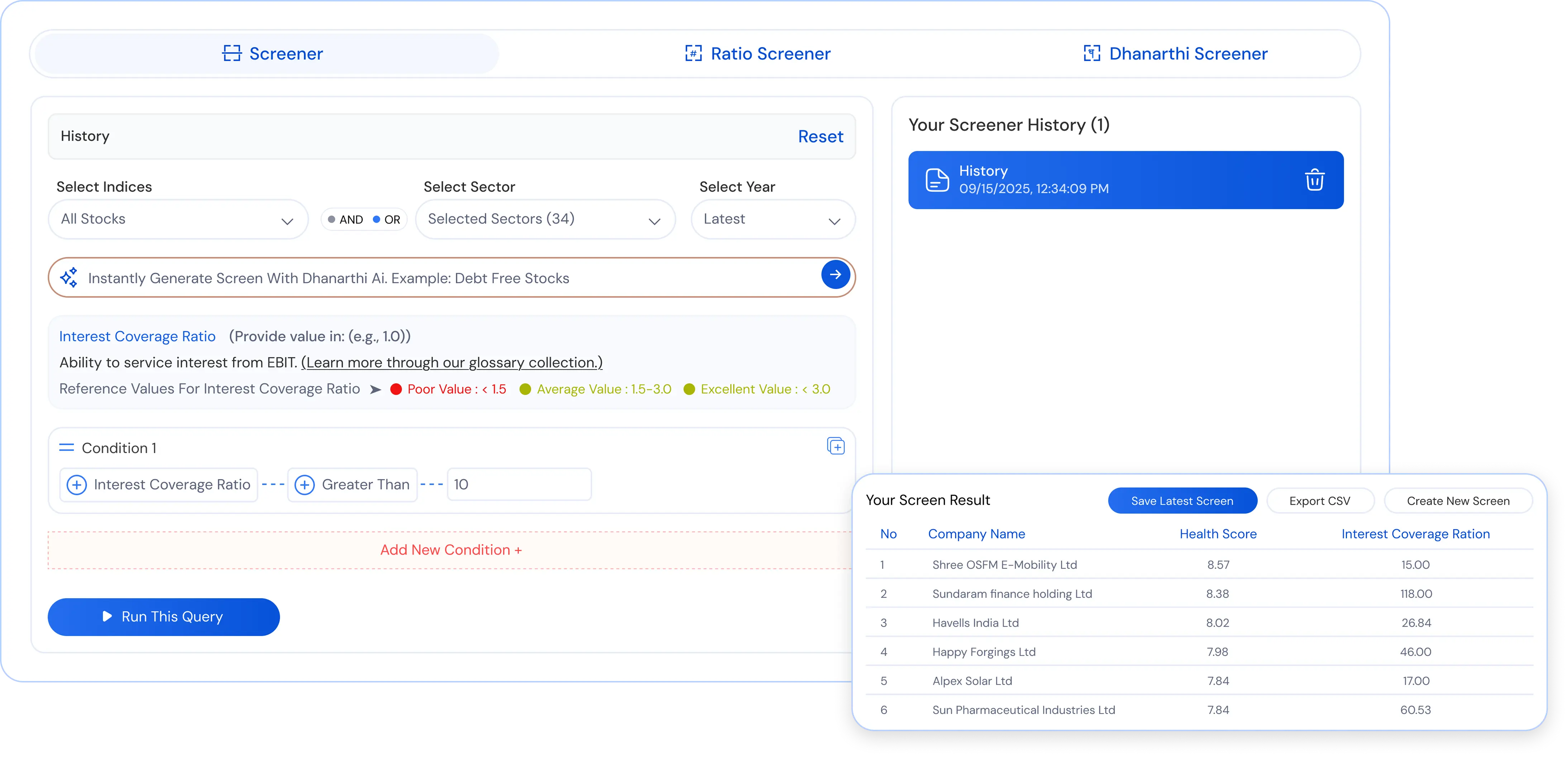

How to Use Our Screener?

Learn how to get the most out of the Stock Screener! In this step-by-step guide, we show you how to use 50+ readymade screeners, 150+ custom filters, and industry-first market research tools. Discover how to filter stocks, analyze key data points, and make smarter, data-driven trading decisions with ease. Watch now and unlock the full potential of your market research!

Use Our Screener

Who Can Use This Tool?

This tool is perfect for all investors, from beginners to experts, including financial analysts and advisors. It helps everyone find the right stocks easily and make smarter investment choices.

Retail Investors (Beginner to Intermediate)

Experienced Traders and Investors

Financial Analysts and Advisors

Institutional Investors and Fund Managers

Financial Content Creators and Educators

Dhanarthi’s Pricing Plans - Get Unlimited Market Research

Get unlimited access to market research with Dhanarthi's Pro plans. Access stock insights, reports & analytics. Try free Today!

| ||||

|---|---|---|---|---|

Free Plan ₹0 / Per Month No Credit Card Information Needed. Login | Claim Now | ||||

| ⯁ Screener Tool | ||||

● Readymade Screens Full Access | ● AI Filter Unlimited | ● Results Limited View | ● History | ● Export & Share |

| ⯁ Report Analysis Tool | ||||

● Financial Reports 2 Credits | ● YouTube Links 2 Credits | ● Concalls Reports 2 Credits | ● Export & Share | |

| ⯁ Stock Research | ||||

● Al Technical Insights 5 Credits | ● Detailed Stock Analysis Full Access | |||

| ⯁ Company Reports | ||||

● Reports Archive Full Access | ● Full Report Analysis Unlimited | |||

| ⯁ Stock Guru Tool | ||||

● Upload Chart & Get Analysis Full Access | ● Chat With AI Agent Unlimited | ● History | ● Export & Share | |

| ⯁ Others | ||||

● Watchlist Unlimited | ● News & Notification Full Access | ● Customer Support Basic Support |

| ||||

|---|---|---|---|---|

Pro Plan Monthly Yearly ₹499 ₹167 / Per Month One plan. Full access. Master Market. Login | Upgrade Now | ||||

| ⯁ Screener Tool | ||||

● Readymade Screens Full Access | ● AI Filter Unlimited | ● Results Full Access | ● History | ● Export & Share |

| ⯁ Report Analysis Tool | ||||

● Financial Reports Unlimited | ● YouTube Links Unlimited | ● Concalls Reports Unlimited | ● Export & Share | |

| ⯁ Stock Research | ||||

● Al Technical Insights Unlimited | ● Detailed Stock Analysis Full Access | |||

| ⯁ Company Reports | ||||

● Reports Archive Full Access | ● Full Report Analysis Unlimited | |||

| ⯁ Stock Guru Tool | ||||

● Upload Chart & Get Analysis Full Access | ● Chat With AI Agent Unlimited | ● History | ● Export & Share | |

| ⯁ Others | ||||

● Watchlist Unlimited | ● News & Notification Full Access | ● Customer Support Dedicated Support |

Why choose Dhanarthi for Market Research?

Get real-time stock data and insights that make market research simple and reliable for everyone.

Complete Market Coverage

4000+ NSE/BSE stocks with real-time updates.

Smart Insights

AI-powered stock screening for accurate decisions.

User-Friendly Design

Simple, intuitive, and easy to use for everyone.

Real-Time Data

Stay updated with live market trends and instant updates.

Custom Screeners

Build strategies that match your trading style.

Trusted by Investors

Thousands of users rely on Dhanarthi daily.

Spot the Best Stocks with Dhanarthi Stocks Screener

Dhanarthi’s Stock Screener puts powerful stock analysis at your fingertips. Explore 50+ ready-made screeners and 150+ custom filters to find high-growth, value, or dividend stocks. Analyze key metrics, track real-time trends, save scans, and export results to CSV. Download the app now!

Frequently Asked Questions

1. What is a Stock Screener, and how does it work?

A stock screener is a powerful tool that helps investors filter, compare, and analyze thousands of stocks based on financial ratios, technical indicators, and sector-specific data.

2. How does Dhanarthi’s Stock Screener help investors in India?

Dhanarthi’s stock screener India makes it easy to discover high-potential companies with strong fundamentals, sectoral insights, and growth opportunities all in just a few clicks.

3. Who can use the Dhanarthi Stock Market Screener?

This stock market screener is designed for retail investors, traders, analysts, institutional investors, and financial educators, making it suitable for beginners as well as experts.

4. Is the Stock Screener suitable for beginners in trading?

Yes. With ready-made screeners and simple filters, beginners can easily start using Dhanarthi’s stock screener India, while experts can explore advanced screening features.

5. What types of stock filters are available in the Screener?

The stock screener offers 150+ filters, including PE ratio, PB ratio, EBITDA margin, debt ratio, and technical indicators, perfect for both long-term investors and intraday screener users.

6. Can I save and share my stock screener results?

Yes. You can create, save, and share your custom stock scans directly from the stock screener India platform with other traders and analysts.

7. How many stocks can I screen at once?

The stock screener allows you to analyze thousands of stocks instantly with multiple filters and advanced screening conditions.

8. What are ready-made screeners in the Dhanarthi platform?

Ready-made screeners are pre-built scans inside the stock market screener that quickly identify trending stocks with strong fundamentals, intraday moves, and technical setups.

9. How can fundamental analysis filters improve stock screener results?

Fundamental filters in a stock market screener help find financially strong companies. Metrics like ROE >15%, low debt-to-equity, consistent earnings growth, and fair P/E ratios highlight stable and growing businesses.

10. What are the benefits of using sector-wise screening in Indian stock markets?

Sector-wise screening in a stock screener in India helps spot opportunities across industries like IT, pharma, banking, and FMCG. It supports diversification and lets investors benefit from sector rotation during different economic cycles.

Try Our Ready-Made Screener Queries

New to stock investing? No problem! Dhanarthi's AI screener offers 50+ ready-made templates for real market data. Access filters for growth, value, and high-profitability stocks. Analyze P/E ratios and key metrics instantly. Make smart decisions with expert screening tools perfect for beginners.

Deep Value Stocks

Identifies fundamentally undervalued companies trading below intrinsic value. These stocks have low price-to-earnings, price-to-book, and price-to-earnings-growth ratios while maintaining strong return on equity. Perfect for value investors seeking stocks with strong fundamentals that the market has temporarily overlooked. These companies typically offer significant upside potential when market sentiment improves and their true value gets recognized.

High Growth Stocks

Targets companies demonstrating exceptional expansion across key financial metrics. These stocks show robust revenue growth, accelerating net income, rising earnings per share, and strong return on equity. Ideal for growth investors seeking companies in rapid expansion phases with sustainable business models. These companies typically reinvest profits to fuel further growth and market share expansion.

Low Debt Companies

Identifies financially conservative companies with minimal debt burden and strong liquidity positions. These stocks maintain low debt-to-equity ratios, excellent interest coverage, and healthy current ratios. Ideal for risk-averse investors seeking financial stability during market volatility. These companies have greater flexibility to weather economic downturns and invest in growth opportunities without financial strain.

High Profitability Companies

Targets companies demonstrating exceptional operational efficiency and profit generation capabilities. These stocks show strong return on equity, healthy operating margins, robust gross profit margins, and solid net margins. Perfect for investors seeking companies with proven ability to convert revenue into profits efficiently. These companies typically have competitive advantages and pricing power in their markets.

Growth Stocks Filter

Prioritizes companies with exceptional expansion potential by weighting revenue growth and earnings per share growth most heavily, followed by net income and operating profit growth. This filter emphasizes sustainable top-line growth combined with earnings expansion and strong returns on equity. Ideal for investors seeking companies in rapid growth phases with proven ability to scale operations efficiently.

Value Stocks Filter

Emphasizes companies with strong asset backing and dividend-paying capabilities by heavily weighting book value per share and dividend metrics. This filter focuses on dividend sustainability, equity strength, and financial stability through interest coverage and debt management. Perfect for value investors seeking undervalued companies with tangible assets and income generation potential providing downside protection.

Dividend Focus Filter

Prioritizes income-generating companies by heavily weighting dividend per share and dividend coverage metrics alongside cash flow strength. This filter emphasizes sustainable dividend policies supported by strong operating cash flows, cash earnings, and capital efficiency. Ideal for income-focused investors seeking companies with reliable dividend payments backed by robust cash generation and sound capital management.

Stocks That Are Undervalued

Filter companies that are trading below their intrinsic valuation metrics.

Love ❤ from India's Traders & Investors

Thousands of Indian investors trust Dhanarthi for their stock analysis and screening needs. Here's what our community has to say about their success stories.

Start Your Stock Market Financial Journey. It's Easy, Fast, and Free!

Start investing smarter with unlimited market research, financial reports, and screening tools.

Let's Start Now